The Fed’s September Surprise: Understanding the Rate Cut Expectations

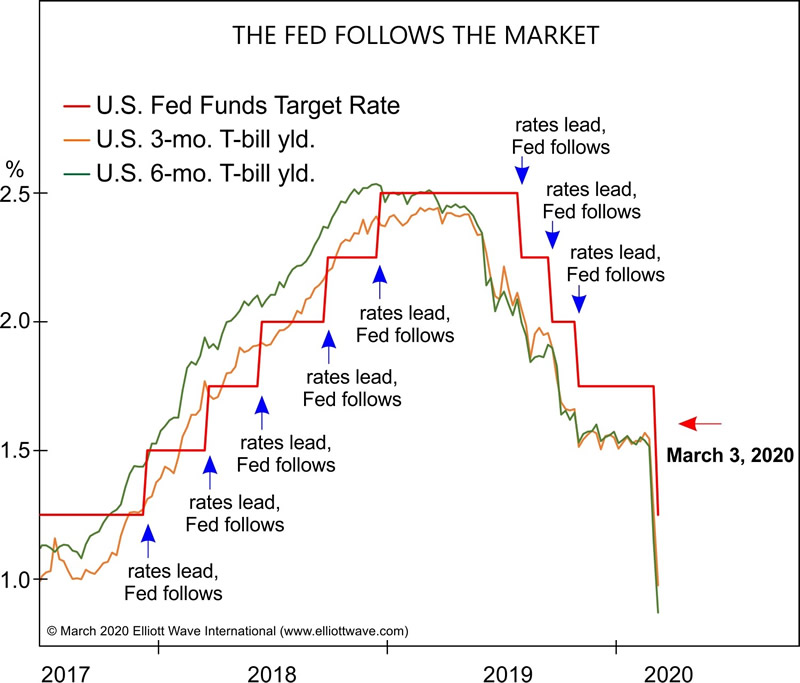

As we approach September, whispers of a potential rate cut by the Federal Reserve have begun to echo through financial circles, but is this really a surprise? The truth is, Fed funds futures have been signaling this cut for some time now. The expectations surrounding monetary policy adjustments can easily spread confusion, especially amidst fluctuating market sentiments.

While some analysts focus on the statistics from the retail sector and the Consumer Price Index (CPI), I find myself drawn to the insights that market movements provide. These indicators are like glimpses into the market’s soul, reflecting the collective sentiment. A quote comes to mind:

“There are three types of lies: Lies, damned lies, and statistics.” – Mark Twain

With this in mind, let’s pour ourselves a Mark Twain cocktail and delve deeper into the Fed fund futures forward curve.

Informed speculations on the forthcoming rate adjustments are brewing in financial discourse.

Informed speculations on the forthcoming rate adjustments are brewing in financial discourse.

Back in late July, as the Federal Reserve convened for its Open Market Committee meeting, the futures curve aptly indicated that a rate cut was off the table for that session. Fast forward to today, and the curve continues to indicate market consensus supporting a likely cut by the conclusion of the Federal Reserve’s September meeting on the 17th and 18th.

It’s fascinating to think that many in the financial community cling to raw data and statistical analysis for decision-making. In contrast, seasoned investors are attuned to the more fluid signals provided by market behavior. This brings a significant advantage, allowing them to anticipate changes that others might overlook.

Riding the Gold Wave Amid Economic Uncertainty

As we navigate through these discussions of rate cuts, let’s not forget gold, the steadfast safe haven. Gold prices have steadily climbed recently — peaking just below $2,500 — largely due to anticipated interest cuts and heightened economic uncertainty.

Technical indicators suggest that gold’s sustained growth might have entered overbought territory; however, in the wild world of investing, markets can remain overbought longer than we can stay solvent. Investors, driven by fear and uncertainty, often turn to gold, thereby steering clear of strict technical evaluations.

The fascination with gold often stretches beyond typical fundamental analysis.

The safety that gold offers in turbulent times often overshadows traditional supply-demand dynamics. It begins to function on a different plane; a domain where geopolitical and economic fears serve as key catalysts for price movements. This is a testament to gold’s historical role during times of crisis.

The Dollar Index Dilemma

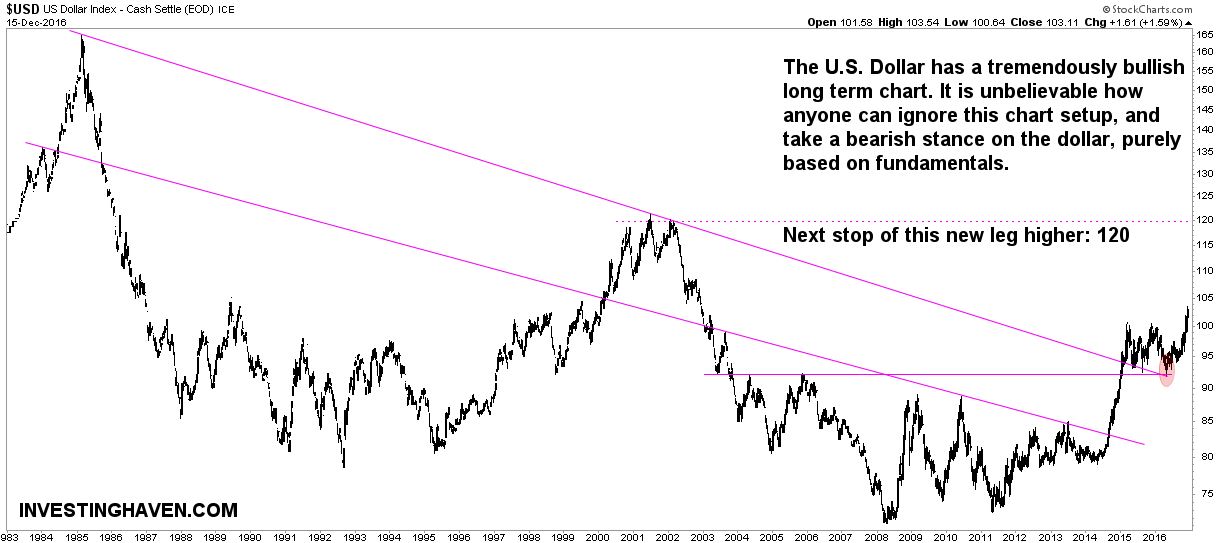

Turning our attention to the U.S. dollar, its performance throughout 2024 has seen a mix of highs and lows, reflecting a somewhat volatile sentiment in the markets. The dollar index currently finds itself in a consolidation phase, dancing between crucial support and resistance levels. By examining its long-term chart, one can see a sideways trend — a struggle between recent highs and lows without a clear direction.

With anticipated interest cuts on the horizon, common economic theory suggests that the dollar should weaken. However, the real world often bends these rules. It leads many financial experts to wonder: how far will the dollar drop before it revives?

The U.S. dollar index reveals the uncertainty surrounding monetary policy.

The U.S. dollar index reveals the uncertainty surrounding monetary policy.

The relationship between the U.S. dollar and gold often draws scrutiny, especially with the looming potential for rate cuts. Logic suggests that a weaker dollar should equate to a stronger gold market. Interestingly, my own research — conducted together with my son, Ben — has shown surprisingly low correlation, hovering around 43% over the last decade. This leads to a perplexing detail: contrary to expectations, the two markets may be more aligned than previously believed.

Conclusion: Awaiting the Fed’s Next Move

As we stand on the precipice of yet another FOMC meeting, an array of uncertainties loom. Will the Fed indeed cut rates as predicted, or will an unforeseen event shift the tide? With the U.S. presidential election approaching, any political shifts could act as wildcards that alter the current economic landscape significantly. The markets are bound to react, and therefore, it is essential to remain alert to these evolving narratives.

There’s much riding on these decisions, and whether you choose to sip whiskey or calculate figures, the coming weeks promise to be fascinating times in the realms of finance and investment.

As always, stay vigilant and may your investments thrive amidst the currents of change.

The upcoming months could fundamentally reshape market dynamics and investor sentiments.